Fact of the matter is, the technology is

Fact of the matter is, the technology is coming here. I mean, at the rate that mobile technology is growing, who REALLY didn’t see this coming? Some banks already allow customers to deposit checks electronically via a scanner and computer. So allowing customers to deposit checks with their smart phones, was the next logical step in my opinion.

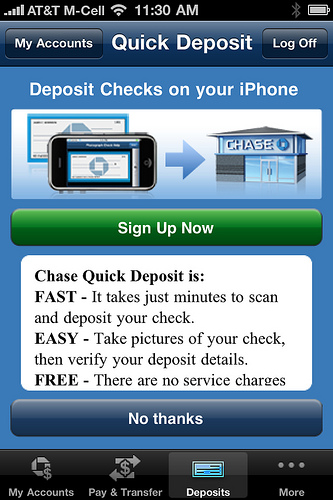

Two banks, Chase and USAA are some of the largest banking institutions to create apps that among other things, give mobile customers the ability to deposit checks using their iPhone, Android & BlackBerry smartphones.

A quick and dirty breakdown of the process is you open the banking mobile app, select the check deposit feature, and the app fires up your mobile camera and you take a picture of the check. The app will let you know if the image is good enough to send and you will get confirmation that the check was sent. Most of the time, the funds are available immediately, once the bank verifies all the banking information. You don’t even have to send in the check afterwards. You can void & file it (for all you hoarders) or shred the check.

Personally, I have some clients (bless their hearts) who still insist on writing checks, even when I show them that I can also take debit & credit cards using my iPad. So I kindly take the check and figure out when is the next time I plan on going to the bank. I am a 99% online banker – Guess what I spend the last 1% doing? So I would jump at the ability to snap an image of my clients check, deposit it into my account, and show my client a confirmation of the deposit.

All small business owners may not have the same blind allegiance to electronic banking when it comes to funds transfers as I do. Even though most banking institutions back mobile banking with guarantees that ensure that your losses are covered in the event your mobile banking info is comprised, I can see how people can be concerned with their accuracy when doing something like depositing checks with their smartphone. I mean we are talking about a small screen with small buttons and ever-deteriorating eyes. So the chance of a user error is logically higher by default.

So what’s your stance? If your bank offered mobile check depositing, would you participate, or do you follow the “if it isn’t broken…” crowd and feel safer with personally depositing checks at your bank?