*Just another reason why I need an iPhone*

*Just another reason why I need an iPhone*

With my Square credit card reader now in my possession, I can now accept credit cards from customers on site without a merchant account via my iPad. But, there are some customers who are still holding on to writing checks. I hate going to the bank, so the idea of electronically depositing checks into my business account via my smartphone would be the ultimate business tool for me.

Well another heavily used business tool of mine is PayPal, and it has just released a new version its iPhone app to do just that. By taking a picture of the front and back of the check, I can send the images to my PayPal account (which is linked to my business account) and wait for the money to be deposited.

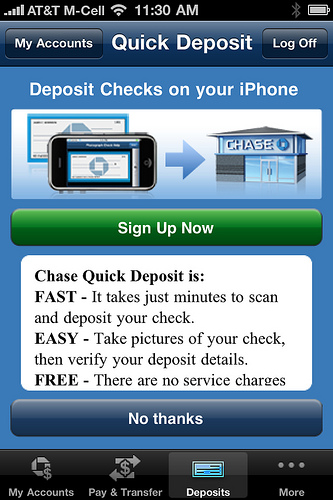

Until now, Chase and USAA were the only two financial institutions with iPhone apps to process checks electronically. Now that PayPal has stepped into the arena (with its MILLIONS of users) to ease folk’s minds about electronic check deposits, look for more institutions to jump on the bandwagon.

*Your move Bank of America*

I will make sure to keep you posted on if and/or when PayPal will release this functionality to rest of us without iPhones *sad face*

Fact of the matter is, the technology is

Fact of the matter is, the technology is