To be honest, The Kashoo Online Accounting service isn’t too much different than a Quickbooks Online, InDinerio or Outright for small businesses. With all of these services, you can set up an account fairly quickly and manage your money using the following features:

To be honest, The Kashoo Online Accounting service isn’t too much different than a Quickbooks Online, InDinerio or Outright for small businesses. With all of these services, you can set up an account fairly quickly and manage your money using the following features:

– Manage income/expenses

– Create and send invoices

– View financial reports

– Manage customer information

…and more without installing software on your computer. Your business finances are at your fingertips just so long as you have internet access (Remember to LOG OFF if you access your account via a public computer). On of the “coolness factors” that sets Kashoo apart from the above mentioned services is that it now has a dedicated iPad app so you can fully control your Small Business finances if you decide to step away from your computer and Go Mobile.

Get it? Small Biz Go Mobile…Nevermind.

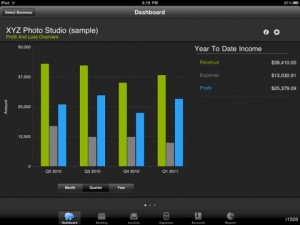

The Kashoo iPad app is a free download from the iTunes App Store that gives you the same access to features and functionality that you would find using the online version. Any changes you make on your iPad will sync with your online account. If you work while you’re offline, your data is backed up and syncs as soon as you connect to a network. Another cool feature about the Kashoo iPad app is that if you don’t have an account, you can set one up using the app, or try out the app using the sample data included…so you don’t mess up your own data!

The Kashoo iPad app is a free download from the iTunes App Store that gives you the same access to features and functionality that you would find using the online version. Any changes you make on your iPad will sync with your online account. If you work while you’re offline, your data is backed up and syncs as soon as you connect to a network. Another cool feature about the Kashoo iPad app is that if you don’t have an account, you can set one up using the app, or try out the app using the sample data included…so you don’t mess up your own data!

Additional Kashoo features include giving business partners and/or your accountant access to just financial reports and not your actual account, in addition to access to your online banking accounts so you can skip manually adding transactions. Finally, Kashoo can be accessed through your Google Apps account to negate logging in to two accounts.

The Kashoo app for iPad is free – setting up an account to try out Kashoo is free for thirty days ($9.95/month for unlimited users thereafter). In my opinion, services like Kashoo is great for contractors, freelancers, and small businesses that may not have a ton of employees or raking in the big dough (yet), but still want to manage their finances like a pro. So check it out and let us know what you think in the comments section