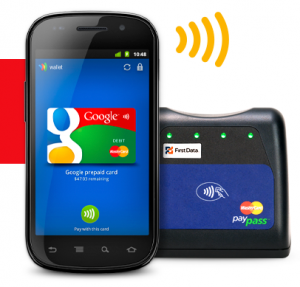

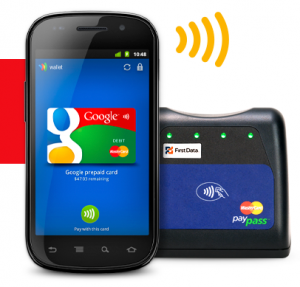

Today we were at Google’s press conference in NYC, it just concluded, and we have to say, the implications could be huge for small business owners, with Google announcing two key new Android apps that will potentially enable your customers to pay you faster by using their mobile phone. The primary app, Google Wallet, will securely store and communicate financial information from users’ phones to merchants’ NFC terminals. NFC (near field communication) is a wireless technology that has been around but is becoming more popular. The other app announced was Google Offers, which serves as a complement to Wallet, integrating coupons and loyalty programs to the transaction experience. Let’s take a look at the features offered by each app, and then consider the implications for small business owners.

Wallet will roll out this summer, though it will initially provide NFC services only with Citi Mastercard and/or a pre-paid Google account. Google promises that more account types (Visa, American Express, non-Citi Mastercards, etc.) will be added in the future, but they didn’t name any specific partners, nor did they offer up any sort of timetable. Despite the limited number of launch-time partnerships, the potential for Wallet is huge, as it’s the first NFC system that allows users to maintain multiple credit accounts within the same NFC client. As Wallet gains wider adoption, more banks and credit agencies will likely jump aboard, which will provide users with an NFC commerce experience as flexible and robust as the current, leather wallet-based transaction process.

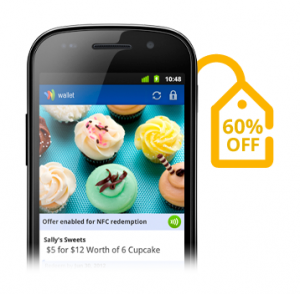

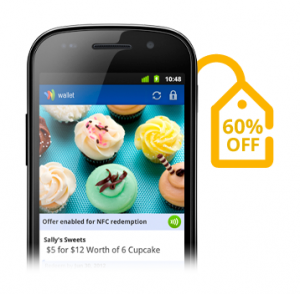

For small business owners, Google Offers promises to be a real game-changer. Google demonstrated how seamlessly Offers integrates with both Wallet and users’ desktop browsing experience; a desktop Google search for “denim shorts” might yield a digital coupon, which can be added into the user’s Offers account through a single click, and then redeemed in person, via Wallet, at the local point-of-sale. Even more exciting is the integration of location-specific coupons and offers into the Android ecosystem; a phone-based search for “sandwiches” could yield offers from nearby restaurants, generating greater first-time customers for local businesses and international franchises alike. Offers will also manage and track customer loyalty programs, which could definitely help transform occasional customers into regular patrons. Google is selectively launching Offers in Portland, San Francisco, and New York this summer, though once the initial bugs have been worked out, the program will likely quickly spread to other cities.

Google also outlined some features that will likely be added to Wallet/Offers over the next several years; digital receipts, transaction-based prizes and games, and eventually the ability to integrate drivers’ licenses, health insurance cards, concert tickets, and hotel keys. What remains unknown, though, is who will be responsible for securing the data of these para-transactional experiences. For the financial information of the transaction itself, Google has partnered with FirstData to provide secure transmission and storage of relevant data, but it’s unclear if FirstData would also be responsible for managing loyalty card information and the like.

There’s a lot of potential here, but what can small businesses expect in the short-term?

To be honest, not much. Currently, the only Android phone sporting an NFC chip is the Nexus S, and it’s hard to build an entirely new commerce ecosystem around a single phone. More NFC-enabled Android phones will likely arrive later this year, but it will take at least several years before a significant number of consumers have Google NFC technology in their pockets. And, with rumors circulating that Apple has an NFC platform of its own in the works, it’s unlikely that Google’s initiative will move forward without some competition from its rivals. The short-term potential of Wallet/Offers is also tempered by the aforementioned lack of launch-time financial partners; how many people have both a Citi Mastercard AND a Nexus S, and how many consumers look forward to regularly refilling a bespoke Google debit account?

Sure, the immediate potential of Google’s announcement is pretty limited, but with NFC terminal readers costing less than $10, merchants won’t be staking a significant financial investment in the technology, should it fail to find widespread consumer adoption. And the long-term potential for small businesses is absolutely huge; if Wallet and Offers become widely adopted by consumers, smaller merchants and local retailers will be able to engage in the type of targeted advertising and sophisticated customer loyalty programs (with their accompanying analytics…) that are today affordable only for medium-to-large companies. If you’re a small business owner in one Google’s trial cities, becoming an early adopter of Wallet/Offers could pay considerable dividends down the road, as your familiarity and expertise with the infrastructure could provide a key competitive advantage, should Google’s NFC become the transactional experience of the future.